Who Is Exempt From Property Taxes In Illinois . you may qualify for a homeowner exemption if the house in question is your primary residence. a property tax exemption is like a discount applied to your eav. If you qualify for an exemption, it allows you to lower your. assessor > property tax exemptions. The most common is the. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. Property tax exemptions are provided for owners with the following situations:. certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill.

from www.illinoispolicy.org

generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. Property tax exemptions are provided for owners with the following situations:. The most common is the. certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. assessor > property tax exemptions. you may qualify for a homeowner exemption if the house in question is your primary residence. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. a property tax exemption is like a discount applied to your eav. If you qualify for an exemption, it allows you to lower your.

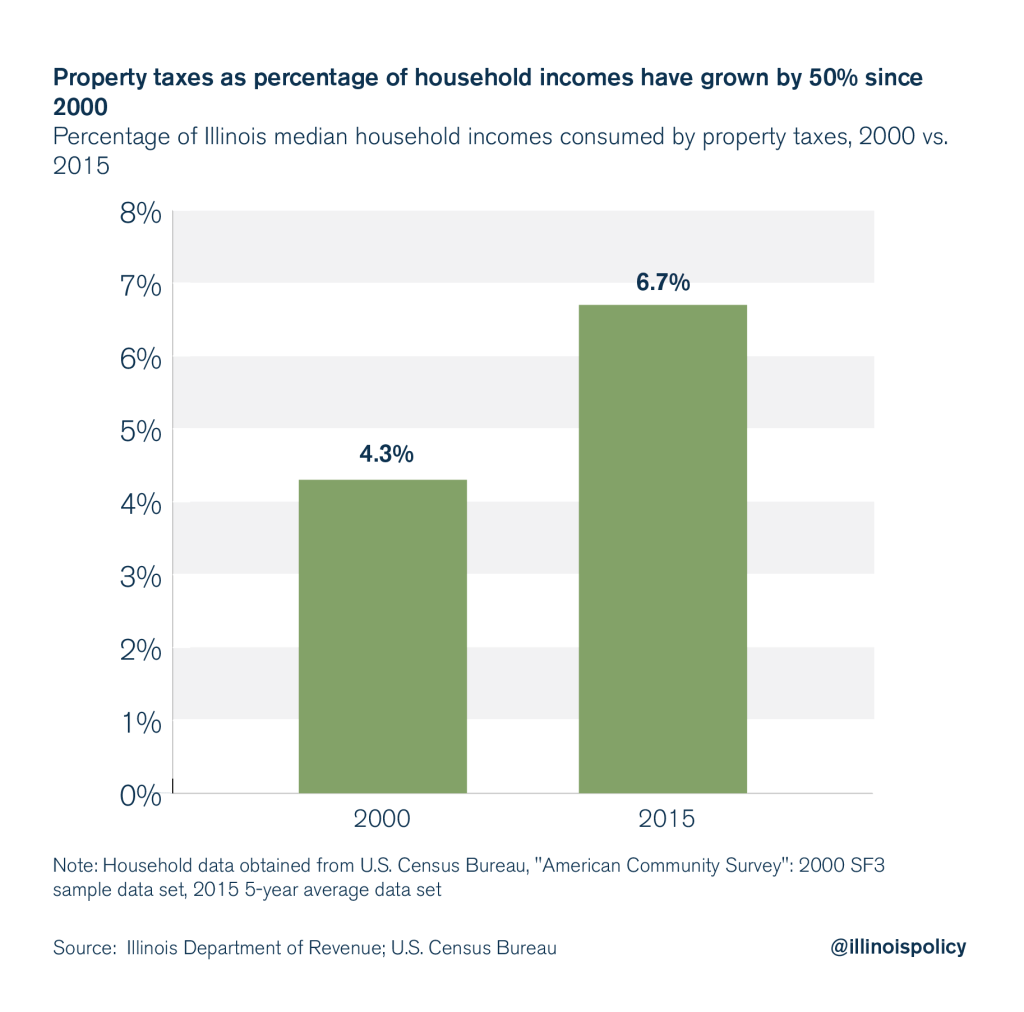

Property taxes grow faster than Illinoisans’ ability to pay for them

Who Is Exempt From Property Taxes In Illinois Property tax exemptions are provided for owners with the following situations:. The most common is the. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. If you qualify for an exemption, it allows you to lower your. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. Property tax exemptions are provided for owners with the following situations:. you may qualify for a homeowner exemption if the house in question is your primary residence. a property tax exemption is like a discount applied to your eav. assessor > property tax exemptions. certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational.

From gustancho.com

Illinois Rising Property Taxes Are Forcing Homeowners To Flee State Who Is Exempt From Property Taxes In Illinois generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. assessor > property tax exemptions. The most common is the. you may qualify for a homeowner exemption if the house in question is your primary residence. Property tax exemptions are provided for owners with the following situations:. . Who Is Exempt From Property Taxes In Illinois.

From exottiwas.blob.core.windows.net

How Much Is The Property Tax In Illinois at Ernest Green blog Who Is Exempt From Property Taxes In Illinois property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. a property tax exemption is like a discount applied to your eav. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. assessor > property tax exemptions. certain entities are eligible for. Who Is Exempt From Property Taxes In Illinois.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them Who Is Exempt From Property Taxes In Illinois certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. Property tax exemptions are provided for owners with the following situations:. The most common is the. a property tax exemption is like a discount applied to your eav. assessor > property tax exemptions. generally, you may be eligible for an. Who Is Exempt From Property Taxes In Illinois.

From localtoday.news

Illinois has the second highest property taxes in the US Illinois News Who Is Exempt From Property Taxes In Illinois If you qualify for an exemption, it allows you to lower your. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. a property tax exemption is like a discount applied to your eav. assessor >. Who Is Exempt From Property Taxes In Illinois.

From prorfety.blogspot.com

Illinois Property Tax Exemption Va Disability PRORFETY Who Is Exempt From Property Taxes In Illinois property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. If you qualify for an exemption, it allows you to lower your. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. assessor > property tax exemptions. Property tax exemptions are provided for owners. Who Is Exempt From Property Taxes In Illinois.

From www.youtube.com

Learn How You Can Automatically Lower Your Property Taxes in Illinois Who Is Exempt From Property Taxes In Illinois The most common is the. you may qualify for a homeowner exemption if the house in question is your primary residence. Property tax exemptions are provided for owners with the following situations:. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. If you qualify for an exemption, it. Who Is Exempt From Property Taxes In Illinois.

From romildoroeler.blogspot.com

when are property taxes due in chicago illinois Jami Sallee Who Is Exempt From Property Taxes In Illinois generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. you may qualify for a homeowner exemption if the house in question is your primary residence. assessor > property tax exemptions. Property tax exemptions are provided for owners with the following situations:. property tax exemptions are savings. Who Is Exempt From Property Taxes In Illinois.

From www.civicfed.org

Estimated Effective Property Tax Rates 20082017 Selected Who Is Exempt From Property Taxes In Illinois generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. The most common is the. you may qualify for a homeowner exemption if the house in question is your primary residence. assessor > property tax exemptions. Property tax exemptions are provided for owners with the following situations:. . Who Is Exempt From Property Taxes In Illinois.

From www.illinoispolicy.org

Illinois homeowners pay the secondhighest property taxes in the U.S. Who Is Exempt From Property Taxes In Illinois property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. Property tax exemptions are provided for owners with the following situations:. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. The most common is the. certain entities are eligible for property tax exemptions. Who Is Exempt From Property Taxes In Illinois.

From www.thetechdiary.com

How to Qualify for Property Tax Exemptions in 2023 The Tech Diary Who Is Exempt From Property Taxes In Illinois certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. assessor > property tax exemptions. a. Who Is Exempt From Property Taxes In Illinois.

From www.illinoispolicy.org

Illinois is a hightax state Illinois Policy Who Is Exempt From Property Taxes In Illinois assessor > property tax exemptions. If you qualify for an exemption, it allows you to lower your. The most common is the. certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on.. Who Is Exempt From Property Taxes In Illinois.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Who Is Exempt From Property Taxes In Illinois a property tax exemption is like a discount applied to your eav. assessor > property tax exemptions. If you qualify for an exemption, it allows you to lower your. property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. you may qualify for a homeowner exemption if the house in question is. Who Is Exempt From Property Taxes In Illinois.

From www.benlalez.com

How Property Taxes Are Collected in Illinois — The Ben Lalez Team Who Is Exempt From Property Taxes In Illinois property tax exemptions are savings that contribute to lowering a homeowner’s property tax bill. Property tax exemptions are provided for owners with the following situations:. If you qualify for an exemption, it allows you to lower your. certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. you may qualify for. Who Is Exempt From Property Taxes In Illinois.

From exottiwas.blob.core.windows.net

How Much Is The Property Tax In Illinois at Ernest Green blog Who Is Exempt From Property Taxes In Illinois The most common is the. a property tax exemption is like a discount applied to your eav. you may qualify for a homeowner exemption if the house in question is your primary residence. Property tax exemptions are provided for owners with the following situations:. property tax exemptions are savings that contribute to lowering a homeowner’s property tax. Who Is Exempt From Property Taxes In Illinois.

From repweber.com

Meaningful, Substantive Property Tax Relief in Illinois is Critical Who Is Exempt From Property Taxes In Illinois generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. you may qualify for a homeowner exemption if the house in question is your primary residence. assessor > property tax exemptions. If you qualify for an exemption, it allows you to lower your. certain entities are eligible. Who Is Exempt From Property Taxes In Illinois.

From gustancho.com

Illinois Rising Property Taxes Are Forcing Homeowners To Flee State Who Is Exempt From Property Taxes In Illinois generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. you may qualify for a homeowner exemption if the house in question is your primary residence. If you qualify for an exemption, it allows you to lower your. assessor > property tax exemptions. The most common is the.. Who Is Exempt From Property Taxes In Illinois.

From crosslinpc.com

Property Taxes Are you exempt as an Exempt Entity? Crosslin Who Is Exempt From Property Taxes In Illinois a property tax exemption is like a discount applied to your eav. generally, you may be eligible for an illinois property tax exemption if you own, occupy and pay taxes on. you may qualify for a homeowner exemption if the house in question is your primary residence. If you qualify for an exemption, it allows you to. Who Is Exempt From Property Taxes In Illinois.

From www.ctbaonline.org

UPDATED Illinois Property Taxes Center for Tax and Budget Accountability Who Is Exempt From Property Taxes In Illinois you may qualify for a homeowner exemption if the house in question is your primary residence. If you qualify for an exemption, it allows you to lower your. The most common is the. certain entities are eligible for property tax exemptions under illinois law, such as charitable, religious, educational. property tax exemptions are savings that contribute to. Who Is Exempt From Property Taxes In Illinois.